Deep expertise to move faster

66ten is WEHI’s first strategic investment fund and one of the largest of its kind dedicated to backing early-stage discoveries within an Australian medical research institute.

In terms of health outcomes, its commercialisation focus is not a detour from discovery – it’s the pathway to impact. Without this crucial step, breakthroughs don’t reach patients and their potential to improve lives is lost.

Spearheaded by WEHI Ventures, 66ten is already drawing attention as a smarter, faster model for translating science into globally investable biotech.

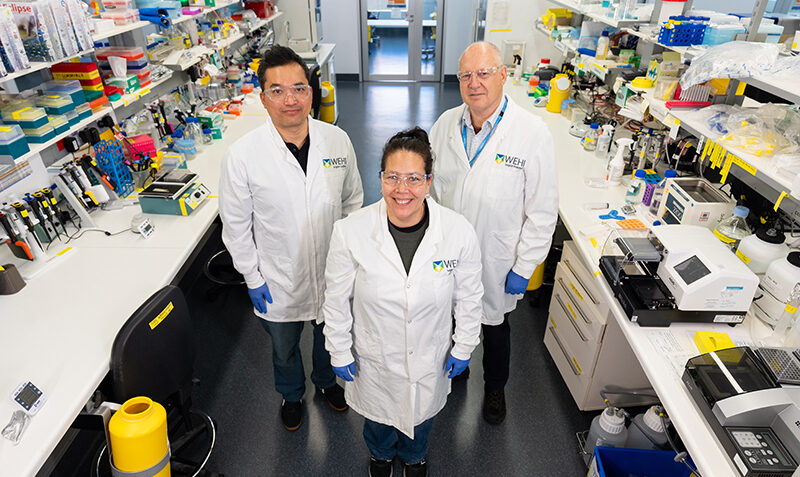

What sets WEHI Ventures apart is its deep bench of expertise.

The team brings together world-class scientific and commercial experience, including former WEHI lab head Dr Leigh Coultas, Dr Lee Booty (former GSK scientist), Dr Heshan Peiris (former Genentech principal scientist), Dr Nicholas Liau (former GSK and Denali Therapeutics scientist), Dr Amanda Woon (former Exogene Head of R&D and Immunocore scientist) and CEO Dr Anne-Laure Puaux, who brings global pharma leadership.

Dr Puaux believes 66ten is fuelling the future of biotech in Australia.

“We’re not just investing in great ideas,” she says. “We’re building the bridge between brilliant Australian science and investable biotech businesses that can thrive in global markets.”