Redefining research discovery and translation

66ten is a strategic investment fund that values scientific excellence and the potential for groundbreaking innovations. Operating as a pre-seed and seed fund enables 66ten to support a range of projects with commercial potential, from initial ideation to projects that have already progressed further in development.

66ten is structured into different investment streams to ensure the fund efficiently supports projects at different development stages. This strategy mitigates risk and streamlines the operation of the WEHI Ventures team.

Dr Anne-Laure Puaux, chief executive officer at WEHI Ventures and head of Business Development at WEHI, said that the institute has an established record of outstanding scientific discoveries.

“66ten was established to transform groundbreaking discoveries into innovative commercial programs that can deliver outcomes for patients and financial returns to investors,” she said.

“It is a unique venture fund that occupies its own space within the venture capital landscape in Australia thanks to WEHI’s long-standing contribution to the medical science fields.”

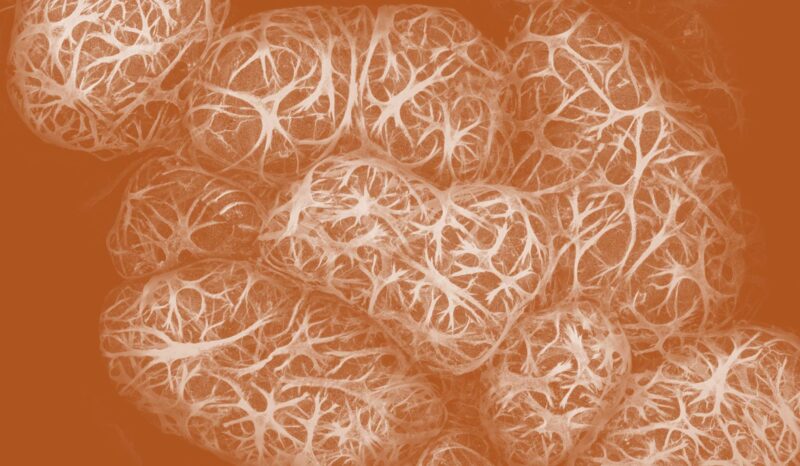

The anti-cancer treatment venetoclax is based on a landmark discovery made by WEHI, placing the institute on the global map for medical innovation. Venetoclax was the result of a research collaboration between WEHI and companies Roche, Genentech (a member of the Roche Group) and AbbVie.

To date, tens of millions of people worldwide have benefited from WEHI research, and more than 420 clinical trials are underway due to discoveries made at WEHI.

“66ten is designed to deliver commercial success for WEHI and its stakeholders, with the aim of shortening the timeframe to patients benefitting from WEHI discoveries,” said Dr Puaux.

“Any financial returns generated via portfolio activities will support WEHI research, discoveries and technologies, to continue WEHI’s fulfilment of its research mission and contribute to the institute’s financial sustainability.”

Dr Roslyn Hendriks, chair of the 66ten Investment Review Committee said that it can be extremely hard for researchers to navigate through the early translational stages of their projects.

“What we are trying to do is to not only offer researchers the financial means to set up projects, but also equip them with the resources and guidance to advance their technologies with commercial potential through the technology readiness levels,” said Dr Hendriks.

“In that sense, 66ten also serves as a vehicle through which to attract science-focused minds at the top of their own fields, as well as funding partners who share the same vision as WEHI. We want to see science-based commercial projects flourish, but equally, we want to see a missing part of the current research and translational ecosystem being filled and a funding landscape that will support and help de-risk more brilliant and innovative technologies.”

66ten commenced operations in July 2023. Through the past year, the fund has invested in a growing set of early-stage programs and start-up companies, each of which is linked to WEHI-based discoveries. These projects received investment under different streams, and some of them are co-investments with renowned biotechnology venture capital funds.

WEHI director Professor Ken Smith said the institute’s vision was for 66ten investments to drive significant human health outcomes across a range of areas of medical science.

“This inaugural WEHI fund was born with the vision to support the ultimate goal of our scientists: to translate innovative research into the treatments, diagnostics and devices needed to help transform patient outcomes,” said Prof Smith.

“Philanthropic and government support will remain critical to WEHI’s success; the 66ten fund will help take brilliant science from lab to bedside, amplifying the real-world impact of research funded by our community of supporters.”